26+ cheapest reverse mortgage

The minimum age may be 62 for a reverse mortgage but older borrowers have more reverse mortgage borrowing power. This type of reverse mortgage is meant for one purpose and that purpose is specified by the lender.

Best Reverse Mortgage Lenders Of 2023 Retirement Living

With a reverse mortgage.

. Single-purpose reverse mortgages are offered by some state and local governments along with some nonprofit agencies. On the HECM Home Equity Conversion Mortgage the formula is 2 of the first 200000 in property value and 1 of every dollar after up to a ceiling of 6000. Web HECM Reverse Mortgage Rates Fixed Rate Payment Options.

Web A reverse mortgage increases your debt and can use up your equity. Web Set-up costs for a reverse mortgage may vary between 1500 and 2000 depending on the lender. Assumes 250000 loan amount and includes 50 Mortgage Insurance standard 3rd party closing costs.

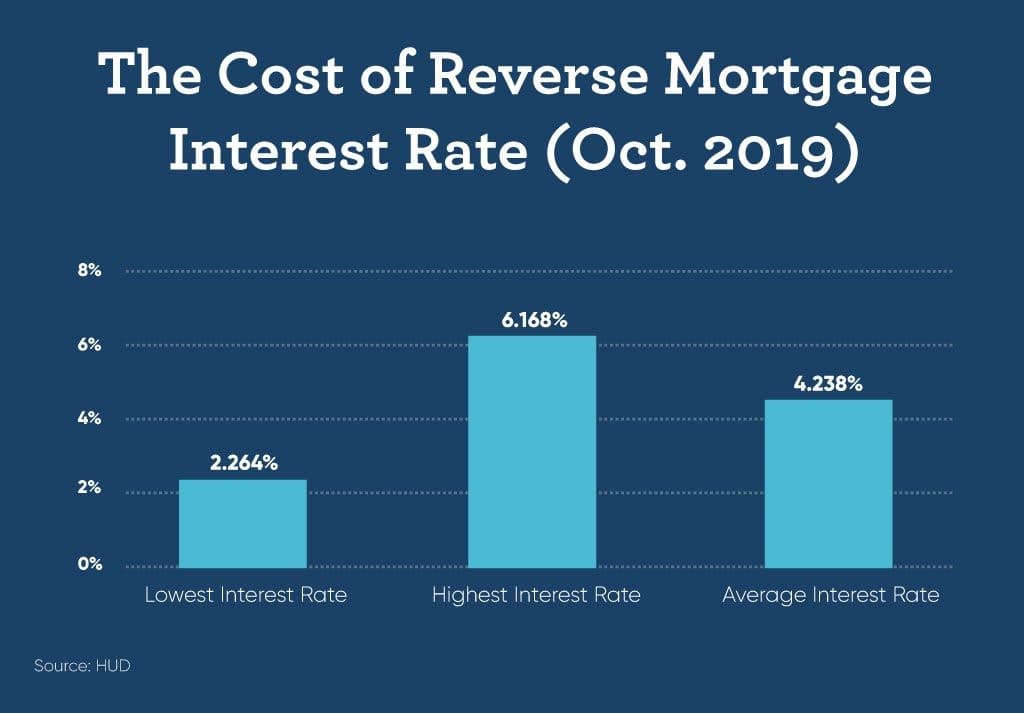

Web The maximum origination fee for a reverse mortgage is dependent on your home value and the product you are going with. Non-HECM rates on what are known as proprietary reverse mortgages could be higher anywhere from 490. Web On a 250000 mortgage with a 20 down payment a 55 interest rate would require a 1136 monthly payment and cost 409128 over the life of the loan.

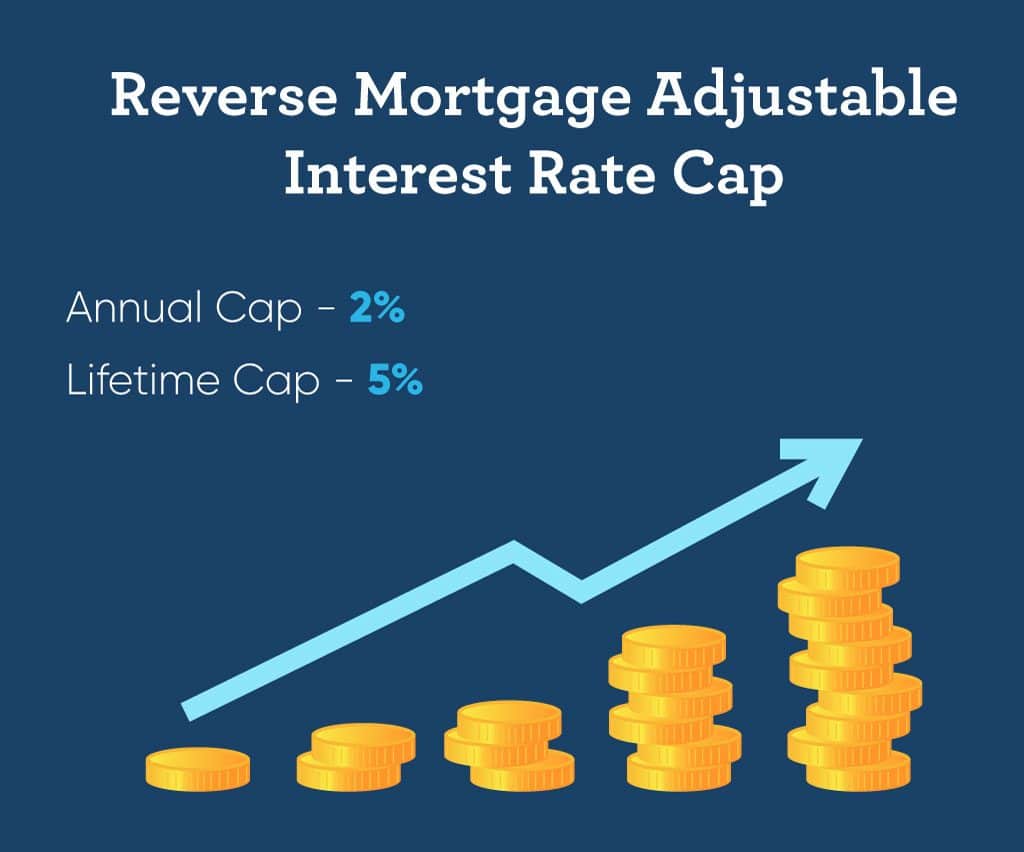

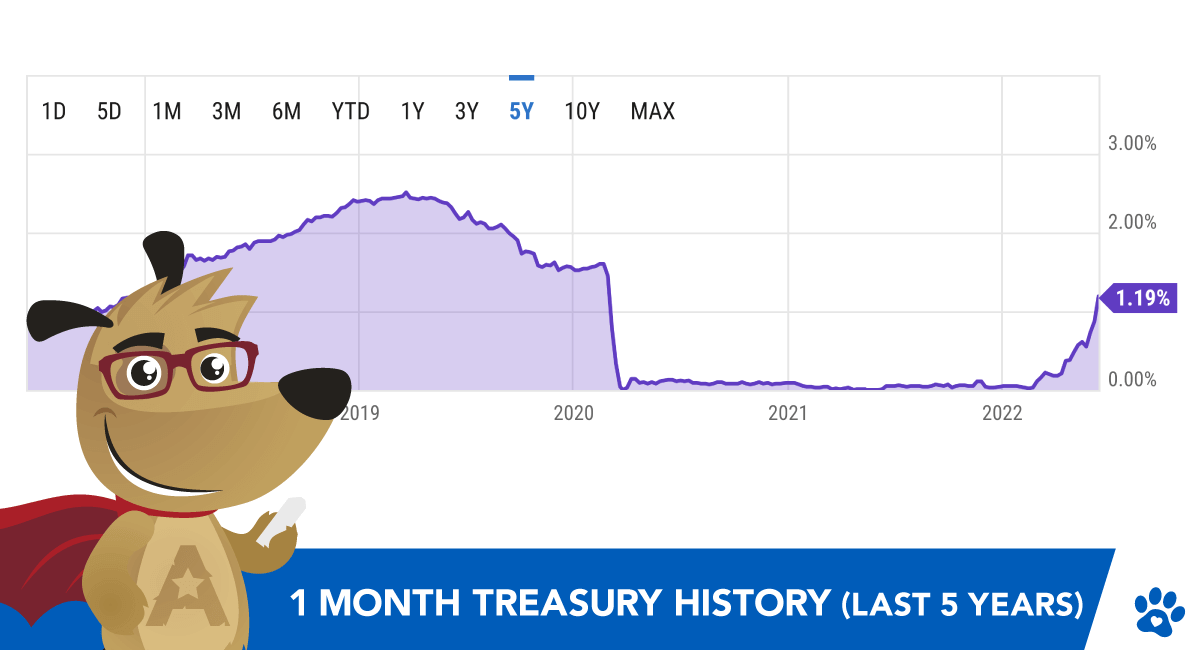

Again theres a lot of information to digest here so lets consider a reverse mortgage example or two. Lump Sum Adjustable-Rate Payment Options. Web A reverse mortgage has very different moving parts compared to a regular mortgage.

Your debt keeps going up and your equity keeps going down because interest is added to your balance every month. According to the CFPB reverse mortgage grievances totaled just 1 percent of all mortgage complaints during a three-year study. A major benefit of a reverse mortgage is that it does not require that you make monthly payments.

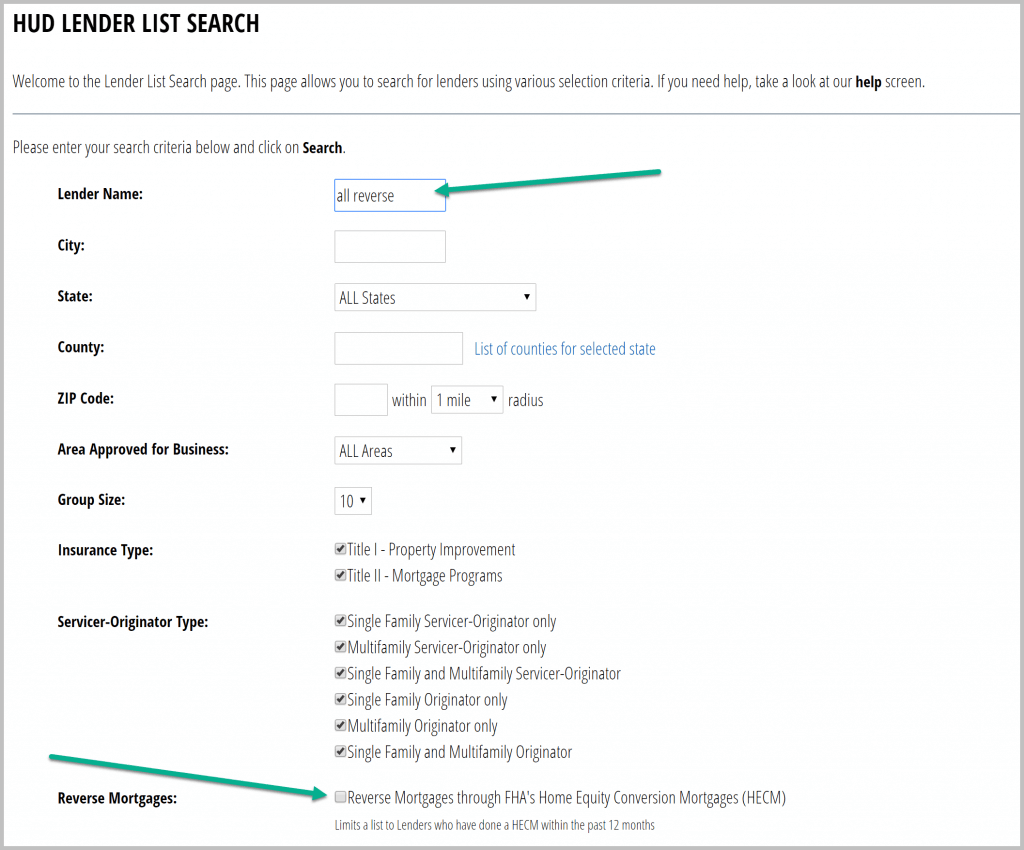

But be aware that brokers get paid by the banks not you so check them out carefully. A reverse mortgage may affect your ability to qualify for the pension. Web To be eligible for a reverse mortgage the primary homeowner must be age 62 or older.

In addition the loan may need to be paid back sooner such as if you fail to pay property taxes or homeowners insurance or dont keep your home in good repair. For loans equal to 60 or less of the homes appraised value this premium. It allows you to convert some of the equity in your home into cash without having to sell the home or move out of it.

Your age is the most important factor in how much you qualify for. Web Reverse mortgages often come with high fees and closing costs and a potentially costly mortgage insurance premium. Web Borrow up to 4 million with a jumbo reverse mortgage Typically waives service fee Cons Only eight branch locations Finance of America Reverse Pros Diverse product range including for those.

Web The home equity conversion mortgage is the most common type of reverse mortgage funding and it is available to qualified borrowers who are at least 62 years old with homes that are paid off. Web Today reverse mortgages are so tightly regulated that as long as you choose a licensed and reputable lender the chances of being conned are extremely low. Web We dove into over a dozen reverse mortgage lenders to assemble the best seven for you based on their costs ease of qualification nationwide coverage speed and customer service reliability.

6680 50 Monthly MIP 7180 in total interest charges. Web For homes worth more than 125000 the lender is allowed to charge 2 on the first 200000 and 1 on the value of the home above 200000 for a maximum of 6000. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and interest.

The best reverse mortgage lenders are available to borrowers with a. Lump Sum Line of Credit Term Tenure Combination. This typically covers the lender application fee government charges legal charges and any broker fees.

Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home. The additional eligibility requirements include. Home Valued at 100000.

Web The single-purpose reverse mortgage is the least expensive reverse mortgage. With a 45 rate the payment goes down to. Web The most common reverse mortgage is a Home Equity Conversion Mortgage HECM which is backed by the federal government.

Web A mortgage broker can shop among many lenders and get better rates than you might on your own. Web A reverse mortgage is a loan for homeowners typically age 62 or older. Web For larger reverse mortgages called jumbo reverse mortgages they ranged from 549 to 650.

You must own the property outright or have at least paid a.

Best Reverse Mortgage Companies For 2023 Fundfirst Capital

Reverse Mortgage Interest Rates 2021 Fixed Variable Goodlife

10 Best Reverse Mortgage Lenders Of 2023 Compare Rating Reviews

Reverse Mortgage Interest Rates 2021 Fixed Variable Goodlife

Current Reverse Mortgage Rates Today S Rates Apr Arlo

Best Reverse Mortgage Companies Of 2023 Money

The Best Reverse Mortgage Lenders Of 2023 Caring Com

The Best Reverse Mortgage Companies Of 2023 Assistedliving Org

:fill(transparent):max_bytes(150000):strip_icc()/AmericanAdvisorsGroup-9de09b98cb084f7680fa500ed62d351e.jpg)

Mgyyv5xrrtjxim

Best Reverse Mortgage Lenders Of 2023 Retirement Living

What Is Reverse Mortgage How It Can Generate Income For Old People Getmoneyrich

Nahb Report Optimistic About Reverse Mortgages

Top 6 Best Reverse Mortgage Lenders 2017 Ranking Reviews Of The Top Reverse Mortgage Companies Advisoryhq

Here Are The Banks That Offer Reverse Mortgages 2023 List

Best Reverse Mortgage Lenders For 2023 Good Financial Cents

Reverse Mortgage How Does It Works Benefits Disadvantages

10 Best Reverse Mortgage Lenders Of 2023 Compare Rating Reviews